Written by Tyra Cameron

Many Jamaicans have often expressed that they do not feel the tangible effects of the “supposed” unprecedented economic growth and resilience occurring in the country. The theory goes that financial benefits given to big business will pass down to smaller businesses and consumers, the so-called, “trickle-down effect”. In economics, the trickle-down effect refers to the rapid gains from overall economic growth which, over time provide benefits to the general public in the form of either jobs or economic opportunities.

The public should expect to feel some of the economic stimulation their country’s economy is experiencing. However, that “trickle down” has proven elusive and seems to exist only in theory and in various economic studies and has notably been discredited by numerous scholars, including Australian economist Heinz Arndt’s in his paper, ‘’The Trickle-Down Myth”, published in 1983 in the University of Chicago Press.

Gross Domestic Product (GDP) is defined as the value of total final finished goods and services produced by a country’s economy at a specified point in time. Simply put, it’s the value of the goods and services produced by the local economy over a period, usually quarterly or annually. This is the most popular economic indicator used by countries to demonstrate their improved or worsened economic position.

GDP became the standard measure of economic development for countries in 1944 at the Bretton Woods Conference. This meeting of 44 nations defined the new rules for the post-World War II international monetary systems and birthed the creation of the International Monetary Fund (IMF). GDP remains the main indicator of a growing economy as it easily quantifies its total production output and how this contributes to the accumulated wealth of a country.

Jamaica had record high levels of GDP growth after the reopening of its borders towards the end of the Covid-19 pandemic; the country registered record levels of GDP growth in 2021-2022 of 3.80%-14.20%. This has affirmed the sentiment that Jamaica has been fully resilient post pandemic and continues to realize economic growth. However, this metric, though a good indicator of the country’s economic output, has its limitations.

GDP is primarily concerned with domestic production and represents the size and strength of the country’s economy based on its producing industries. This doesn’t account for the economic strength of the economy’s population, so although we speak on the strength of the economy, the economic strength of the participants of that economy is equally important to provide a better context to the country’s performance.

To properly account for Jamaica’s economic development, we should champion other economic indicators that complement GDP such as the Gross National Income (GNI) and the Gini coefficient. The lesser-known economic indicator Gross National Income (GNI) better accounts for the income received by the country. GNI is the sum of the country’s GDP in addition to the income its residents earn whether domestically or overseas.

Utilizing this alternative metric would be more useful as it accounts for the income earned by the economic participants and not just the country’s production capacity. On the other hand, the GNI may provide further distortion as it accounts for income earned by residents who may not permanently reside in the country. As such, in addition to GNI, an economic measure which directly speaks to the distribution of income within the country’s society, the Gini coefficient, is useful.

The Gini coefficient is a statistical measure of economic inequality. Income inequality speaks to how evenly income is distributed throughout a population. The coefficient is measured from 0 to 1, with a measurement closer to 1 indicating higher income inequality. Jamaica’s most recent measured Gini coefficient by the Statistical Institute of Jamaica (STATIN) in 2017 was 0.3748 or 37.48%. This means that, in 2017, the country had an unequal but adequate income distribution with room for improvement. This outdated statistic has, however, most likely changed over the last six years as the country has contended with the COVID 19 pandemic as well as inflationary pressures which could have possible dampened the income distribution domestically.

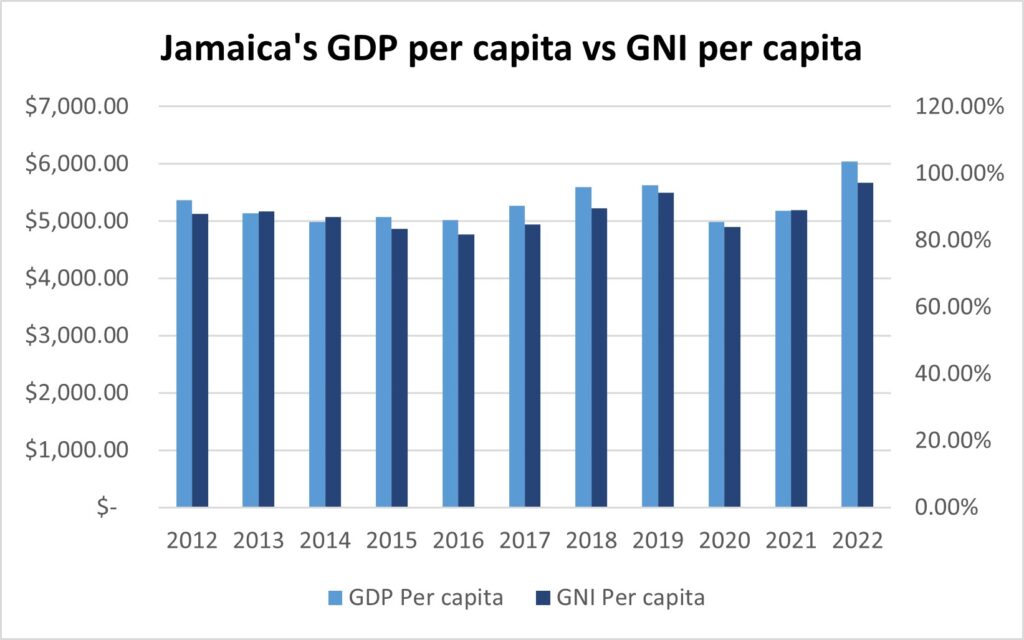

Figure 1: Jamaica’s GDP per capita has been higher than GNI per capita for the last 10 years

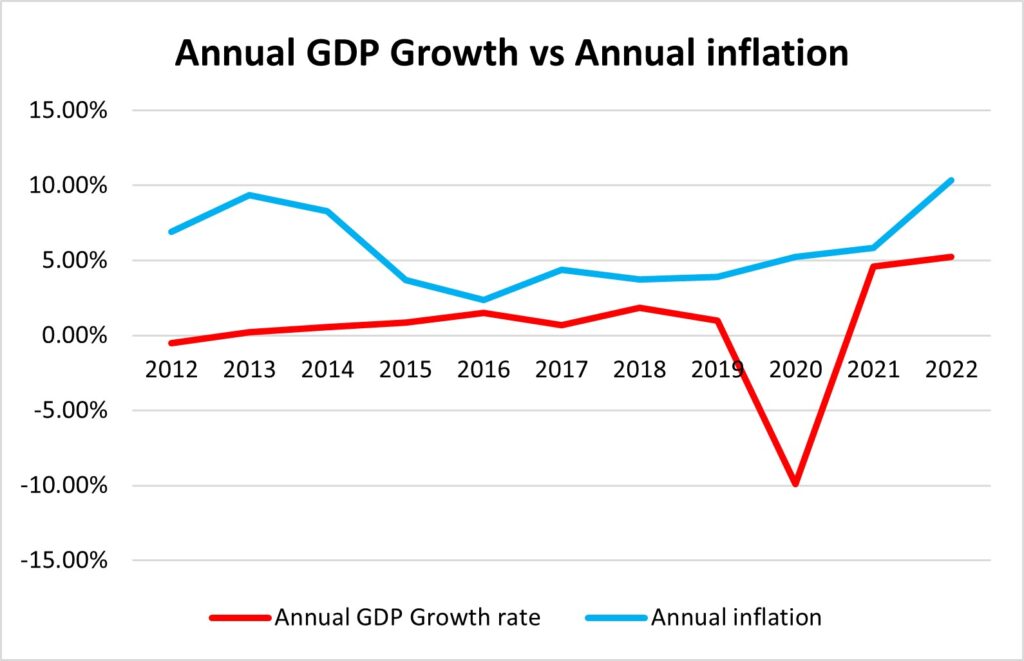

Figure 2: Jamaica’s Annual inflation rate has outpaced GDP growth for the last decade.

Source: World Bank

In Figure 1 presented above, GDP per capita is higher than GNI per capita. Importantly, the GNI per capita figure includes income earned by Jamaicans abroad, indicating that a purely domestic figure would be even lower. Hence GDP per capita being consistently higher than GNI per capita demonstrates that the country’s output per person has been higher than the country’s income per person for the last decade. If we only speak of GDP per capita this important observation is overlooked which thus makes the country’s economic performance appear better than it is.

Furthermore, figure 2 indicates that over the past decade, annual inflation has consistently surpassed any GDP growth recorded on the island. This discrepancy could be a contributing factor to the populace not experiencing the positive impacts of economic growth, as they contend with elevated inflation levels, reflecting increased living costs.

This notion gains support from the findings of the National Bureau of Economic Research’s Working Paper titled “Does Inflation Harm Economic Growth,” published in 1997 which concludes that inflation hampers investment levels and the efficient utilization of production factors. Therefore, juxtaposing Jamaica’s economic output growth with other economic metrics provides a more comprehensive understanding of the country’s overall performance.

Relying solely on GDP as an indicator of improvement, without considering the performance of other economic indicators, fails to offer a complete picture. GDP alone does not encompass aspects such as social welfare or the income distribution among the population, potentially leaving economic participants perplexed about the apparent improvement in the country without corresponding increases in their benefits.

Tyra Cameron is a research analyst at VM Wealth Management with experience in Economic and Equity analysis.

Sources: Statistical Institute of Jamaica (STATIN), World Bank, International Monetary Fund (IMF), Harvard Business Review, JSTOR, Corporate Finance Institute (CFI), National Bureau of Economic Research (NBER) (NBER Working Paper No. 6062)